- Home

- Departments

- J through Z

- Treasurer's Office

- Where Your Property Taxes Go

Where Your Property Taxes Go

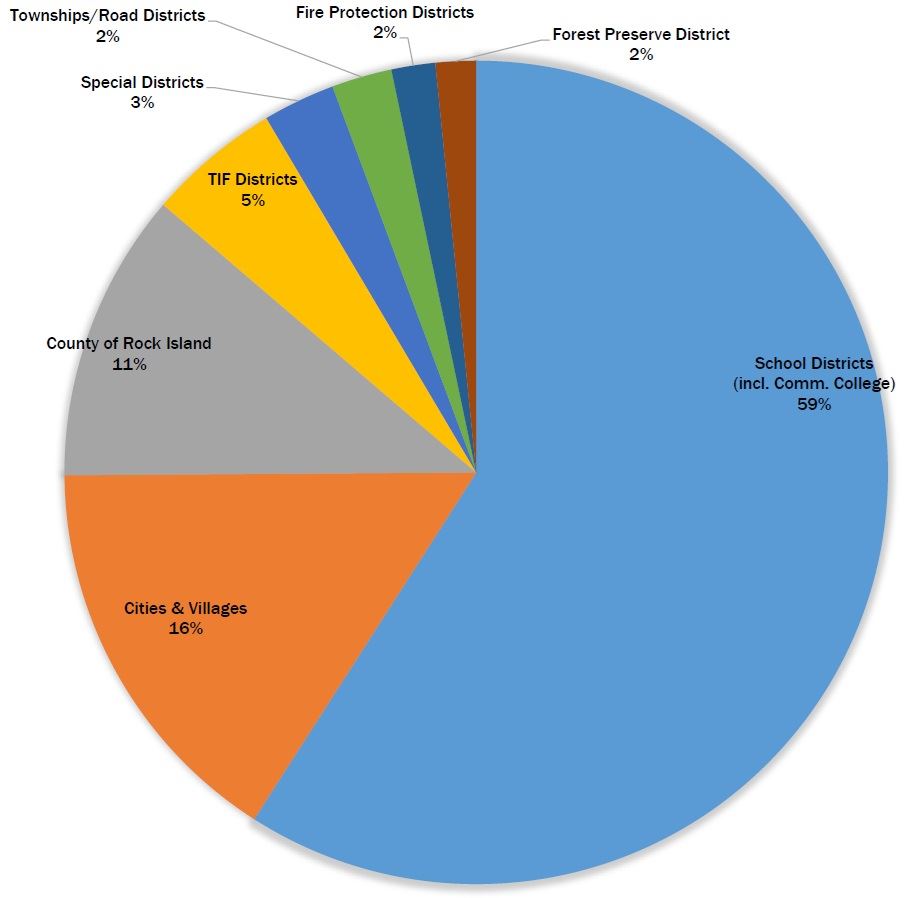

2024 Taxes Payable in 2025

- Schools (including Comm. College) : $190,926,829.57

- Cities and Villages: $49,956,473.87

- County of Rock Island: $33,954,933.30

- TIF Districts: $16,512,265.56

- Special Districts: $8,979,581.86

- Townships/Road Districts: $7,247,323.87

- Fire Protection Districts: $6,116,870.73

- Forest Preserve Districts: $4,319,455.16

- Total: $318,013,733.92

See the tax rates by Township Tax Code (PDF)

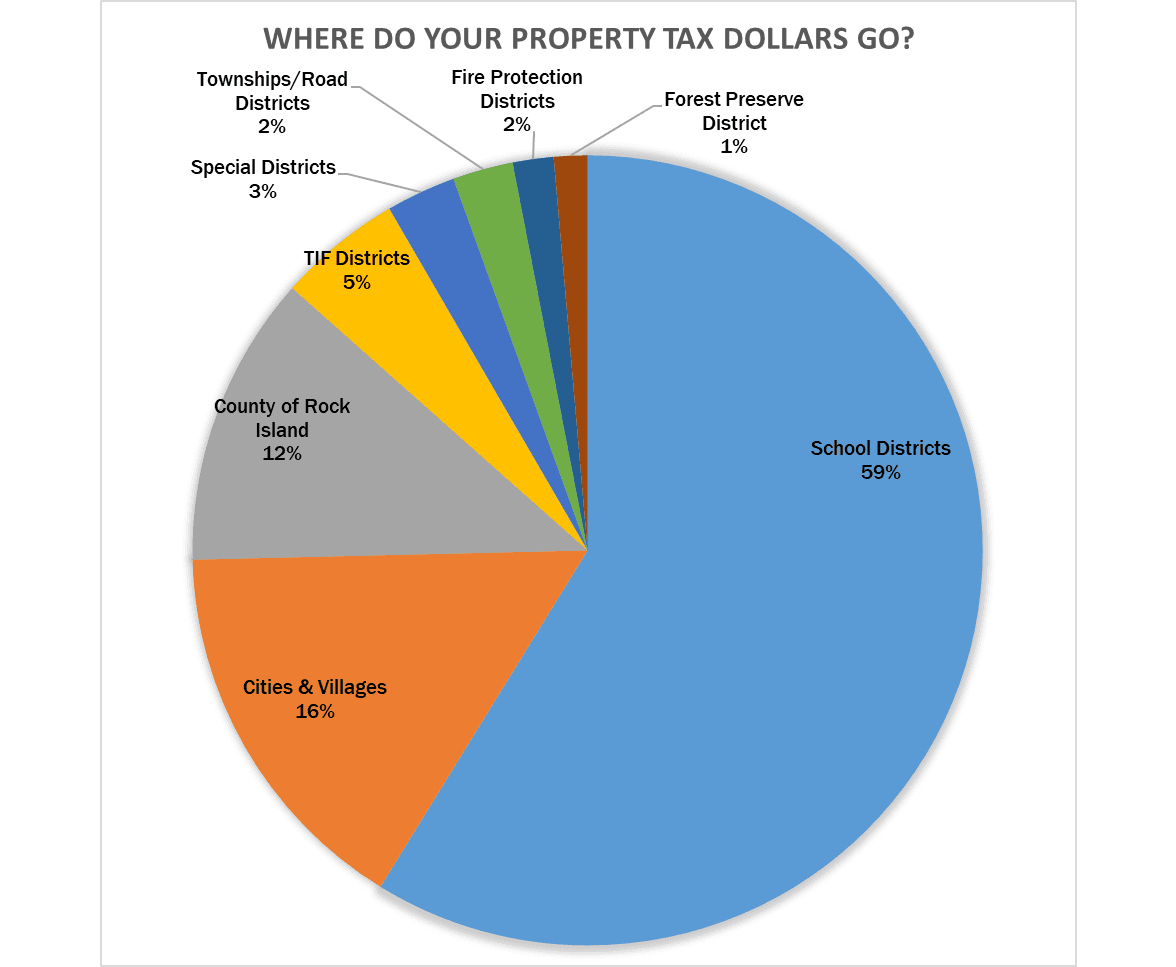

2023 Taxes Collected in 2024

- Schools: $174,102,245.17

- Cities and Villages: $46,632,385.64

- County: $33,528,247.74

- TIFs: $15,401,172.56

- Special Districts: $8,360,699.71

- Townships/Road Districts: $6,977,199.69

- Fire Protection: $5,070,656.67

- Forest Preserve District: $4,674,041.89

- Total: $294,746,649.07

See the tax rates by Township Tax Code (PDF)

2022 Taxes Collected in 2023

- Schools: $163,828,673.87

- Cities and Villages: $44,138,792.86

- County: $33,256,099.98

- TIFs: $14,141,156.20

- Special Districts: $7,956,330.37

- Townships/Road Districts: $6,890,538.35

- Fire Protection: $4,655,581.37

- Forest Preserve District: $3,822,378.67

- Total: $278,689,551.67

See the tax rates by Township Tax Code (PDF).

2021 Taxes Collected in 2022

Schools: $155,095,252.02

- Cities and Villages: $41,524,741.39

- County: $36,571,015.88

- TIFs: $19,144,409.36

- Special Districts: $7,589,100.40

- Forest Preserve: $3,686,938.44

- Cordova Park: $150,022.17

- Townships/Road Districts: $6,863,709.90

- Fire Protection: 4,018,102.89

- Total: $274,643,292.45

See the 2021 tax rates by Township Tax Code (PDF)

2020 Taxes Collected in 2021

Schools: $151,280,108.61

- Cities and Villages: $40,713,984.74

- County: $35,617,326.06

- TIFs: $22,273,462.16

- Special Districts: $7,535,601.11

- Forest Preserve: $3,579,660.90

- Cordova Park: $155,092.51

- Townships/Road Districts: $6,730,096.99

- Fire Protection: $3,806,697.66

- Total: $271,692,030.74

2019 Taxes Collected in 2020

Schools: $149,357,702.44

- Cities and Villages: $40,855,097.50

- County: $35,967,036.78

- TIFs: $21,158,587.84

- Special Districts: $11,165,976.52

- Townships/Road Districts: $6,804,852.03

- Fire Protection: $3,462,639.73

- Total: $268,771,892.84

2018 Taxes Collected in 2019

- Schools: $146,751,377.94

- Cities and Villages: $39,830,

919.48

- County: $33,028,870.40

- TIFs: $19,828,514.64

- Special Districts: $10,875,562.27

- Townships/Road Districts: $6,691,885.27

- Fire Protection: $3,154,550.65

- Total: $260,161,680.65

2017 Taxes Collected in 2018

Schools: $145,424,145.20

- Cities and Villages: $38,633,800.06

- County: $29,472,002.13

- TIFs: $18,588,093.72

- Special Districts: 10,967,234.53

- Townships/Road Districts: 6,619,162.43

- Fire Protection; 3,050,553.56

- Total: $252,754,991.63

2016 Taxes Collected in 2017

Schools: $140,066,513.33

- Cities and Villages: $36,639,824.02

- County: $27,788,627.72

- TIFs: $19,083,659.84

- Special Districts: $10,103,235.40

- Townships/Road Districts: $6,484,207.41

- Fire Protection: $2,791,891.24

- Total: $242,957,958.96

2015 Taxes Collected in 2016

Schools: $135,782,014.51

- Cities and Villages: $35,551,819.30

- County: $26,940,668.29

- TIFs: $18,273,983.04

- Special Districts: $9,816,449.94

- Townships/Road Districts: $6,415,926.74

- Fire Protection: $2,714,020.44

- Total: $235,494,882.26

2014 Taxes Collected in 2015

Schools: $130,770,899.72

- Cities and Villages: $35,093,891.40

- County: $22,242,002.07

- TIFs: $16,637,734.12

- Special Districts: $9,542,775.80

- Townships/Road Districts: $6,345,411.82

- Fire Protection: $2,699,285.87

- Total: $223,332,000.80

2013 Taxes Collected in 2014

Schools: $129,096,424.54

- Cities and Villages: $34,986,130.54

- County: $21,339,446.61

- TIFs: $16,282,713.08

- Special Districts: $9,349,622.85

- Townships/Road Districts: $6,315,466.75

- Fire Protection: $2,659,268.45

- Total: $220,029,072.82